The Rare Earth Bubble Is Over

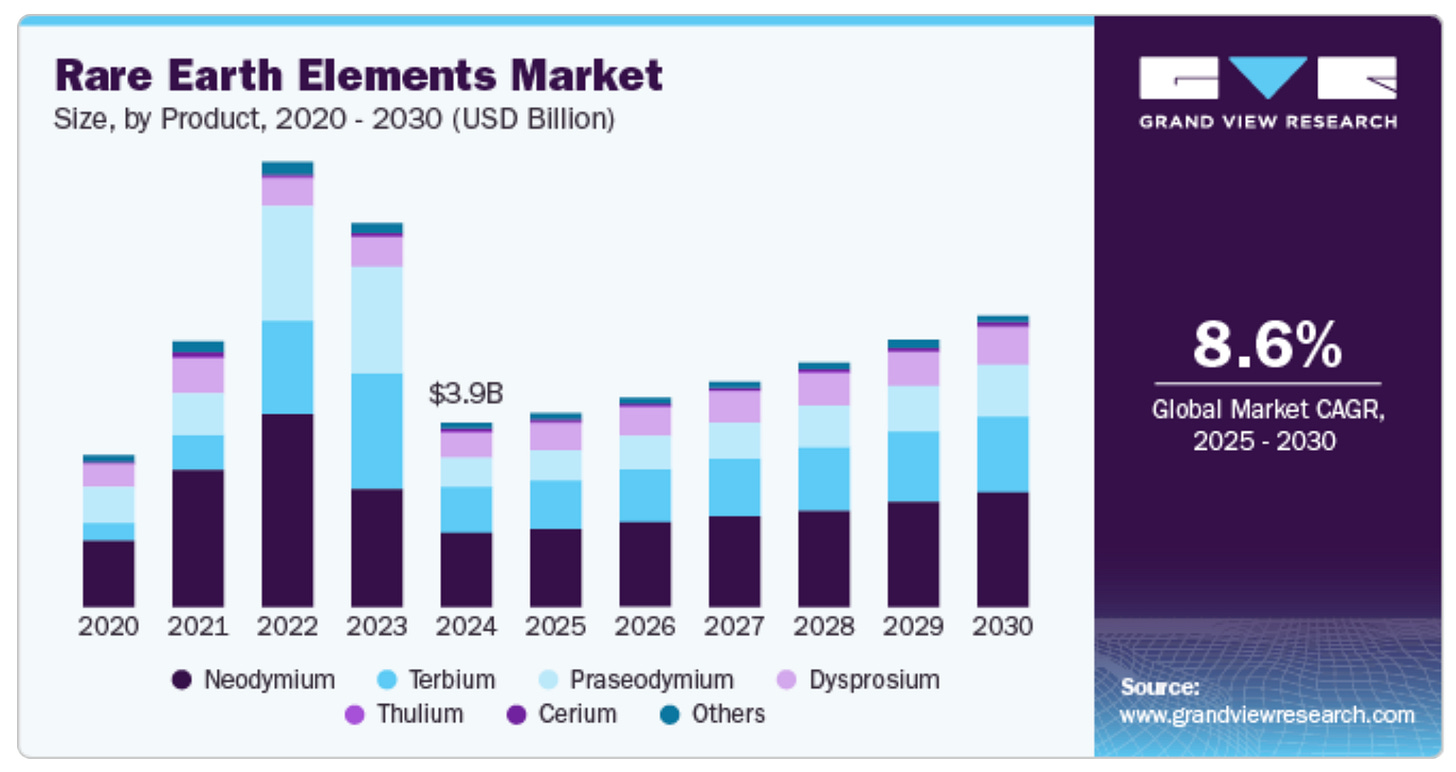

In 2024, global revenue from mining rare earth elements was less than $4 billion, 0.1% of oil & gas revenue.

You hear a lot about rare earths these days: in Ukraine, in Greenland, in Canada.

But this market research report estimates that the total global rare earth market last year was a Dr. Evilesque four … billion … dollars! In contrast, global oil and gas revenue was over $4 trillion dollars, more than one thousand times as much.

So why is everybody talking about rare earths?

Well, from 2020 to 2022, global revenue from rare earths more than doubled, due to supply chain disruptions due to covid and politics, rapid growth in demand for electric vehicles, China tightening exports, and speculators’ excitement over the larger role rare earths play in the then fashionable green technologies like electric vehicles and wind turbines.

But then the market came crashing back down to earth in 2024, as the Biden Administration promoted rare earth mining in California and processing in Texas after decades of hassling by environmentalists, and the dominant Chinese responded with lower prices to punish foreign investors.

This is not to say that rare earths will be a bad investment in the future the way they’ve been very recently. Research reports forecast growth in the range of ten percent annually.

Rare earths aren’t actually all that rare. They are found all over, but they are hard to find in large concentrations that can be mined without much environmental degradation. The Harvard International Review reported in 2021:

REEs describe the 15 lanthanides on the periodic table (La-Lu), plus Scandium (Sc) and Yttrium (Y). Contrary to what the name suggests, REEs are abundant in the earth’s crust. The catch is that they come in low concentrations in minerals, and even when found, they are hard to separate from other elements, which is what makes them “rare.” Perhaps these elements also get their name from being rarely discussed, even though everything from the iPhone to the Tesla electric engine to LED lights use REEs. Demand for these elements is projected to spike in coming years as governments, organizations, and individuals increasingly invest in clean energy. An electric car requires six times the mineral inputs of a conventional car, and a wind plant requires nine times more minerals than a gas-fired plant. … But REEs also have grim prospects: the way companies extract REEs largely damages communities and contaminates surrounding areas. …

Both methods produce mountains of toxic waste, with high risk of environmental and health hazards.

So, China currently dominates mining and refining of rare earth elements because the Chinese government doesn’t care as much about pollution.

But that also means that there’s no shortage of rare earths in an absolute sense, just at the paltry prices we are accustomed to paying.

It seems pretty crazy to organize foreign policy around rare earths, because they are so common.

FWIW, investors aren't falling over themselves looking for investments in capital intensive industries that produce commodities. In fact, the either of those characteristics, 'capital intensive' or 'commodity' are toxic for investments. Everyone wants capital efficient or capital light investments in firms that have a moat or product that is protected. Cereal grains, the classic commodity still sell for $5 bushel, roughly what they did 100 years ago, in spite of massive inflation.

I like 'I Just Want to Celebrate', but I was never much of a fan, otherwise.